Swing Trading For All

SWING TRADING is one of the most popular trading approaches, well known among the traders , because of its high reliability . It is not so slow as Position trading when several orders are executed during the year , nor so fast as Scalping , used TF 5 -1 min . or even lower .... It tries to capture Market movements within one to several days .That is why it is suitable for Novice traders too . In fact ... if someone master this trading approach , he may apply it in any time frames .

It is highly reliable because :

- - Positions are opened in the direction of the present trend ( Remember - " The Trend is your Friend " ) ;

- - Precise entry allows using very tight Stop Loss ;

- - Profit might be unlimited ;

- - That's why it has High Reward to Risk Ratio .

- I - Impulse ;

- C - Correction ;

- E - Expansion .

This is most common pattern when the Market is trending . That is why firstly , the trend should be recognized .

- Recognizing the Trend

Every financial Instrument , no matter of its Time Frame is in one of those two modes : Trend or Range .

In Trend mode , the price makes a significant big movement in relatively short time period . This is an Impulsive movement . InRange mode - the opposite - in long time period the price makes small movement , often a correction .

The simplest method for describing it is by using Lines of Support and Resistance , Trend Lines and Price channel .

A Trend ( for example Upward Trend ) starts with strong Up Price movement , breaking out the previous Resistance Line or Down Resistance Trend Line , and it continues to make Tops and Bottoms where every next Top is higher than the previous one and every next Bottom is higher than the previous one .

- Stage 1 - IMPULSE

In Elliott Waves theory , the Impulse is described as a waves pattern with specific structure . Also , different Indicators may confirm it too... MAs , MACD , Momentum , Williams %R .

.... But this is NOT the right moment for opening the position . Swing Traders are smart and patient . They know that this may be a false break out , leading to adverse loses. More over, they know that every Impulsive movement is followed by a Correction. So they wait for some more time to get precisely in the Market.

- Stage 2 - CORRECTION

By using Pending Stop Order , the position should be opened when the price start moving in the desired direction or some false entries will be reduced .

Swing Traders know that even the best Set Up may fall . Losing trades happen , they must be accepted . So applying the Proper Risk Control and Money Management is essential part of the Trading .

- Stage 3 - EXPANSION

Depending on the Trading Plan may be set Take Profit , or may be used Trailing Stop . Both have advantages and disadvantages . The smart Swing Traders are disciplined and follow the main rule " Keep the loses small , let the winnings run " , so finally the profits exceed losses.

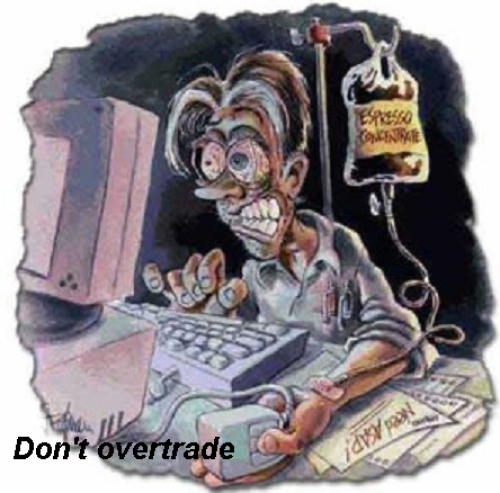

I.C.E. pattern is not something new , original invention... it is well known pattern maybe in different names like 1-2-3-4 or another . But it is doesn't matter ... more important is to be found in the charts and traded with confidence . Mastering this approach is a great opportunity for big profits . But be careful... follow the rules of your Trading Plan ... and DON'T Overtrade .

Swing Trading For All

![Swing Trading For All]() Reviewed by Unknown

on

20:32

Rating:

Reviewed by Unknown

on

20:32

Rating:

No comments: